Introduction

Many industrial buyers encounter the same frustrating situation:

Their injection molding project is technically sound, the design is mature, and the annual volume is reasonable. Yet, large, well-known injection molding suppliers either decline the project or return a quote that seems unjustifiably high.

This reaction is often misunderstood as a lack of interest or capability.

In reality, it reflects a deeper issue: most large injection molding companies are not structured to support low-volume industrial projects.

Understanding why these projects are frequently rejected requires looking beyond machines and pricing, and instead examining how different suppliers are fundamentally organized.

Rejection from a large injection molding supplier is rarely a sign of a flawed design—it is a sign of market misalignment.

Why Big Injection Molding Suppliers Avoid Low-Volume Projects

The Business Model Conflict: OEE vs. Disproportionate Effort

Generally, most large injection molding companies are optimized for high-throughput and minimal engineering intervention per project. Their profitability is governed by Overall Equipment Effectiveness (OEE), where the most expensive state for a machine is downtime. That means low-volume industrial projects disrupt the operating logic of high-throughput molding businesses.

For example, in a high-volume facility, a 4-hour setup is amortized over 30 days of 24/7 production. However, for a low-volume industrial order of 500 parts, that same 4-hour setup might equal the total press time. This 1:1 Setup-to-Run ratio means 50% of the machine’s billable time is lost to non-productive labor, creating an opportunity cost that large suppliers cannot justify without charging prohibitive setup fees.

The NRE Hurdle and Engineering Opportunity Cost

Low-volume industrial projects usually demand disproportionate engineering involvement.

Unlike consumer goods, industrial parts require rigorous evaluation of material trade-offs, environmental stressors, and long-term stability- efforts categorized as Non-Recurring Engineering (NRE). These tasks, including DFM (Design for Manufacturing) and mold flow simulations, do not scale with part quantity; a 500-unit run requires the same engineering bandwidth as a 500,000-unit run.

That’s why large firms always strategically allocate their engineering talent to contracts with high Life-of-Program (LOP) value, viewing low-volume parts as a low-ROI distraction that consumes high-value human resources.

Technical Mismatch: Tooling Philosophy and Performance Liability

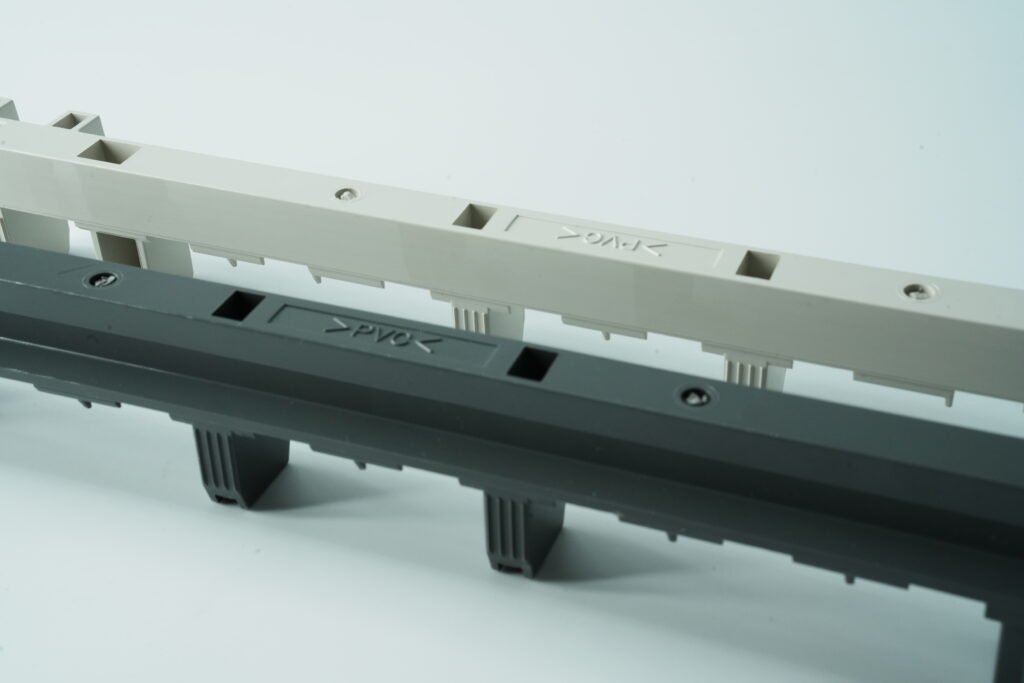

The infrastructure of a Tier-1 supplier is built for “Class 101” hardened steel molds designed for millions of cycles, whereas industrial projects often only require the durability of Aluminum 7075 or P20 steel.

Furthermore, industrial parts frequently utilize high-performance engineering resins (e.g., PEEK, Ultem, or Carbon-fiber PPA). Switching a 500-ton press from a commodity ABS run to a specialized resin requires extensive “purging” of the screw and barrel; for small orders, the cost of wasted purging material can actually exceed the value of the finished parts.

Injection Molding Supplier Comparison: High-Volume vs. Low-Volume Production

| Feature | Tier-1 High-Volume Suppliers | Agile Low-Volume Specialists |

| Tooling Material | Hardened H13 Steel | Aluminum 7075 or P20 Steel |

| Cavitation | Multi-cavity (8 to 128) | Single or Double cavity |

| Cycle Optimization | Speed-focused (seconds saved) | Stability-focused (part integrity) |

| Material Specialty | Commodity Resins (PP, ABS) | Engineering Resins (PEEK, PPS) |

| Quality Focus | Statistical Process Control (SPC) | Individual Part Validation |

Conservative Processing and Long-Term Risk

Finally, industrial projects often require conservative processing windows. To ensure dimensional stability and reduce residual stress in thick-walled parts, cycle times may be intentionally slowed down. This focus on integrity over speed is the antithesis of the high-volume model.

Additionally, industrial components carry a higher performance liability; failures often occur in the field years after delivery. Large-scale suppliers, built for the rapid turnover of consumer goods, are typically unwilling to assume this long-term technical risk for limited production volumes.

The Real Cost Driver Is Not Machine Time

One of the most common misconceptions in injection molding pricing is the assumption that machine time dominates cost.

For industrial parts, the dominant cost driver is rarely machine time.

The dominant cost driver is engineering attention. Which includes:

- Evaluating material behavior under real service conditions

- Balancing strength, stiffness, creep, and aging characteristics

- Defining tooling strategies that prioritize dimensional stability

- Validating assumptions through testing rather than datasheets alone

These activities require experience, judgment, and time, which cannot be automated or compressed without increasing risk.

Large suppliers, optimized for volume efficiency, often struggle to justify this level of attention for low-volume projects.

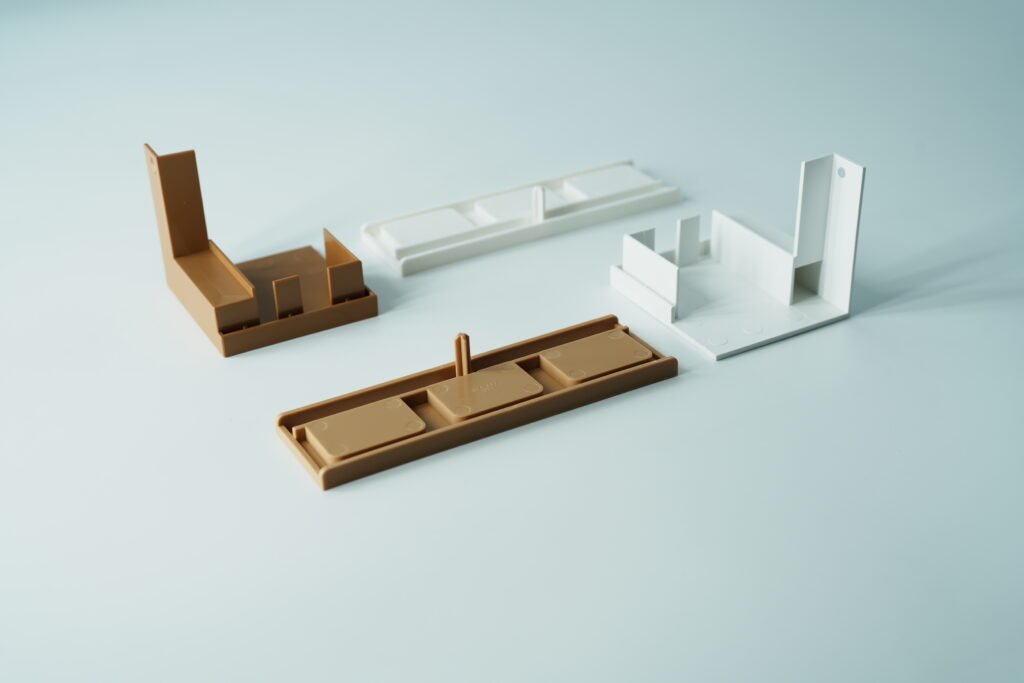

Why Low-Volume Industrial Injection Molding Is a Specialization

Contrary to common belief, low-volume industrial injection molding is not a compromise solution.

It is a distinct specialization.

Suppliers who succeed in this space approach projects differently:

- Volume expectations are aligned with realistic business models

- Tooling cost is evaluated against lifetime performance, not just unit price

- Early engineering involvement is treated as a necessity, not an overhead

- Design feedback is integrated into the process rather than resisted

Instead of maximizing output, the priority becomes risk reduction and long-term reliability.

This mindset is fundamentally incompatible with mass-production-focused operations—but highly effective for industrial applications.

Decision Matrix: How Industrial Buyers Should Sourcing

Before sending an RFQ, use this internal checklist to determine if a supplier is the right fit:

- Is your annual volume < 5,000 units per batch? Seek “On-Demand” specialists.

- Is the material an engineering grade? Ensure the supplier has dryers and high-temp barrels for resins like Ultem or PEEK.

- Is the lead time critical? Ask about “Rapid Tooling” or “MUD (Master Unit Die)” systems.

- Does the part require secondary operations? (e.g., ultrasonic welding, CNC machining, or heat staking). Low-volume specialists are often better at these manual-intensive processes.

FAQ: Navigating Low-Volume Injection Molding

Q: What is considered “Low-Volume” in industrial injection molding?

A: In the industrial manufacturing sector, low-volume injection molding typically refers to production runs ranging from 50 to 5,000 units. However, the “sweet spot” for most precision industrial projects lies between 500 and 2,000 units.

The definition is governed by the economic break-even point of tooling.

Below 50 units, processes like CNC machining or 3D printing are usually more cost-effective. Above 5,000 units, the industry shifts toward high-capacity Class 101 hardened steel molds. Low-volume specialists fill the gap by utilizing Bridge Tooling (typically Aluminum 7075 or P20 steel), allowing for production-grade parts with significantly lower upfront capital investment and faster lead times.

Q: How can we make our low-volume project more attractive to suppliers?

A: To make a low-volume project more attractive to injection molding suppliers, the key is to reduce engineering uncertainty and upfront tooling effort.

From a supplier’s perspective, providing a production-ready CAD file with appropriate draft angles—typically around 2 degrees—signals that the design already considers moldability. In addition, specifying a commercial or functional surface finish instead of a high-gloss cosmetic finish significantly reduces tooling complexity, polishing time, and risk.

Together, these choices help suppliers evaluate the project more quickly, lower their internal engineering workload, and make small-batch production commercially viable.

Q: Why are quotes for low-volume injection molding often higher than expected?

A: The primary reason for higher-than-expected quotes is the Fixed Cost Amortization. In injection molding, the initial costs of engineering, mold design, and machine setup are constant, whether you produce 100 parts or 100,000.

When these fixed costs are spread over a small number of units, the “price per part” naturally rises. Here is a breakdown of the three “Hidden Drivers” behind low-volume pricing:

- Non-Recurring Engineering (NRE) & Setup Fees

- The “Purge” and Material Waste

- Complexity vs. Scale

Q: When is injection molding the wrong choice for low-volume projects?

A: While injection molding offers unmatched part integrity and material options, it is the wrong choice when the upfront tooling cost cannot be amortized within your project’s budget or when the design is still in flux.

In the industrial sector, you should consider alternatives in the following three scenarios:

- When Total Quantity is Under 50 Units

- When the Design is Not “Frozen”

- When Geometric Complexity Exceeds Molding Capabilities

Injection molding delivers its greatest value when design stability and long-term performance matter more than short-term flexibility.

Without those conditions, alternative manufacturing methods are usually more practical.

Quick Decision Matrix:

| Factor | Use Injection Molding | Use CNC / 3D Printing |

| Quantity | 500 – 5,000+ units | 1 – 100 units |

| Design Status | Finalized (Frozen) | Prototyping (Iterative) |

| Material Needs | Production-grade resins | Limited material properties |

| Surface Finish | High-quality / Uniform | Machining marks / Layer lines |

Conclusion: Choosing the Right Partner for Low-Volume Injection Molding

A rejection from a large supplier is rarely a reflection of your project’s feasibility; rather, it is a clear sign of Market Misalignment. Large-scale injection molding companies are built for high-throughput repetition, not the technical nuances required by low-volume industrial parts.

Success depends less on machine size or factory scale, and more on whether a supplier is organized to treat engineering decisions as the core value, not as an exception.

When supported by appropriate engineering judgment and realistic expectations, injection molding remains the most powerful manufacturing solution for industrial components, offering material properties and precision that other methods simply cannot match.

By adopting a “High-Touch, Low-Volume” philosophy, you can shift your sourcing strategy toward agile partners who prioritize technical precision over sheer throughput.

At XDL, we specialize in the projects others decline—supporting low-volume industrial designs with flexible tooling strategies and engineering-driven manufacturing support.

Ready to move from rejection to production?

- Request a DFM Review: Let our engineers evaluate your CAD files for low-volume optimization.

- Get a Precision Quote: Receive a transparent cost breakdown for your 50 to 5,000-unit run.